Taxpayers face increased millage rate

Published 10:10 am Tuesday, September 16, 2014

The Board of Supervisors approved the 2014-2015 budget with the 4.06 mills increase at Monday’s meeting. The new millage rate of 105.48 mills allots 52.67 mills for Lincoln County and 52.84 mills for the county school district.

Eddie Brown, president of the board, explained at the meeting that the increase is just for the schools, not the county. He added that the board has no control over the school’s budget; the supervisors just levy the taxes on behalf of the school district. He also advised concerned citizens who were present at the meeting to discuss the millage increase at the Lincoln County School Board meeting.

“Here’s the rest of the story,” said Lincoln County School District Superintendent Terry Brister.

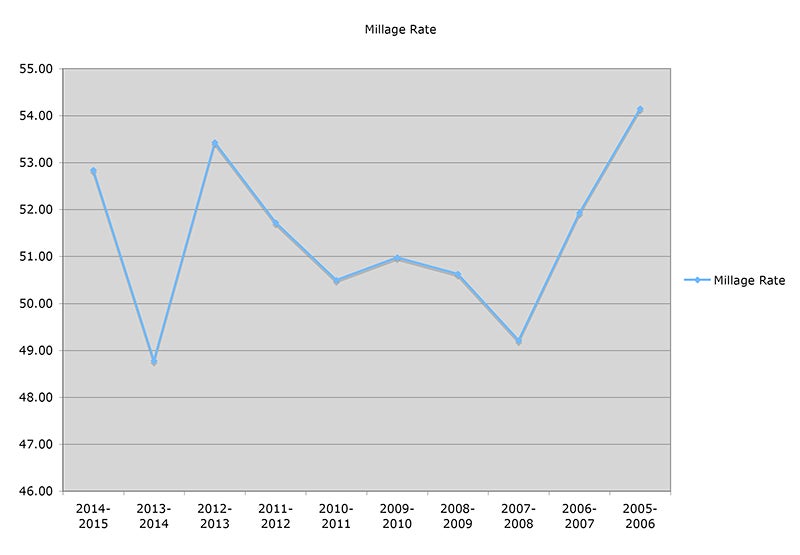

In response to recent discussions at the Supervisors meetings about the ad valorem millage rate, the Lincoln County School Board reviewed the district’s millage rates over the last ten years to shed some light on the issue.

“In school year 2012-2013, the district received more dollars than requested and had to ‘escrow’ the extra funds, which means these extra dollars would be used to reduce the amount requested for the 2013-2014 school year,” said school district business manager Cheryl Shelby. “This reduction in school year 2013-2014 millage was a result of using one-time funds held in escrow for that purpose and resulted in the lowest millage rate on record for the last 10 years.”

Shelby said the school district does not increase the millage rate as suggested. They come up with a budget for the school year and the amount of ad valorem dollars that are requested is determined by a set formula that is dictated by the state, then the county sets the millage rates. The $190,004 the school district returned was added to the county’s general fund.

Lincoln County Administrator David Fields said when the school district decreased their millage rate in 2013-2014, the Board of Supervisors took the opportunity to increase their millage rate to make up for the difference, keeping the overall combined millage rate the same as the previous years.

Fields said like most organizations, the taxes go up because the costs go up. He said inflation and other variables go in to calculating millage.

Shelby said at face value it looks like the school board increased the millage, when in fact they have asked for the same money amount as they received the year before.

The school records show the current millage rate is 1.31 mills less than the millage from ten years ago, despite inflation. A dollar in 2005 has the same buying power as a $1.22 in 2014, according to the U.S. Department of Labor. A statement released by the school board said tax records show that while their millage rates have gone down over the past 10 years, the County Board of Supervisors has increased 9.41 mills over the same time period.

“For school year 2013-2014, the Lincoln County School District returned 4.65 mills back to the county. It is unclear if the reduction in millage by the school district was returned to the taxpayers or used elsewhere by the County Board of Supervisors,” stated the report.

The escrowed mills ($190.004 in taxes collected) that was returned to the county was put into the county’s general fund, said Fields.

According to school records, the school district’s millage rate of 52.84 for the 2015 year is still less than the 2013 millage rate of 53.43. The 4.06 increase is also less than the 4.65 reduction returned to the county for 2014.

“We try to make sure we take care of our tax payers dollars,” said Superintendent Terry Brister. “We have gone out of our way putting emphasis on not putting more taxes and more burden on pocketbooks. We’re getting blood out of a turnip.”

Shelby said by law, after the numbers are put in to the state dictated formula, the school district has the right to request an additional four percent increase, but has not. She added there have been several opportunities for the schools to request additional funds, but they have not because they do not want to increase taxes.

“We have fought not to raise taxes,” said Brister. “Even with things going up in cost over the 10-year period, we’ve held tight. It’s something to be proud of. This board works hard to make sure money is well spent and is doing a pretty good thing here. Our schools have made improvements academically, financially and structurally over the past ten years. Compare where we were then with where we are now.”

Brister said that the board realizes there is only one industry in the county, the rest is from families.

“I challenge all parents and all tax payers to go out and look at our campuses and know that we do it with only one industry,” he said.