Mississippi House restarts push for road, bridge money

Published 9:03 pm Wednesday, January 3, 2018

JACKSON (AP) — The Mississippi House of Representatives and House Speaker Philip Gunn are wasting little time in the 2018 Legislature renewing their push for more road and bridge money.

But even the leader of the House Transportation Committee Charles Busby said the five bills passed Wednesday by House committees are unlikely to raise the money needed to maintain state and local roads.

“This does not fix our problems, nor do I think any of the bills we passed today fixes our problem,” the Pascagoula Republican said. He said he hopes lawmakers will consider additional proposals, including increasing fuel taxes and raising fees for electric vehicles.

The bills move to the full House for more debate.

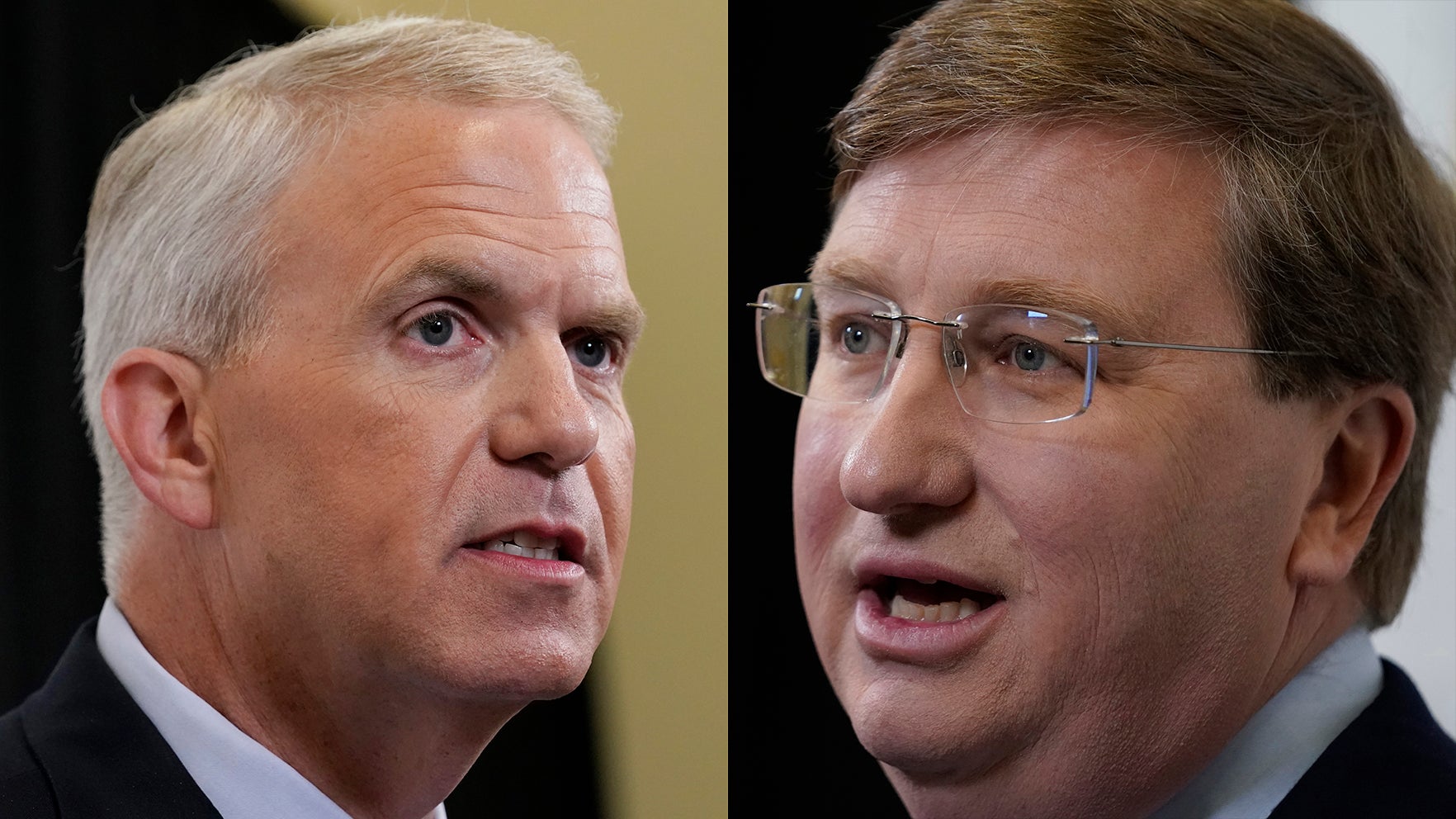

The 2017 Legislature deadlocked over a plan to designate growth in taxes on online sales to transportation, with Lt. Gov. Tate Reeves opposing the move. Some conservative groups dispute the need for more spending, but lawmakers remain under pressure from business groups and transportation leaders who say Mississippi needs to spend hundreds of millions more to maintain current roads. The Mississippi Economic Council, the state’s chamber of commerce and a prominent supporter of more money, visits the capitol Thursday for an annual lobbying day.

The online tax proposal, House Bill 358 , would designate for transportation any amount of tax between $50 million and $250 million collected voluntarily by online sellers. Half would go to the state and half would be split by cities and counties.

Reeves hasn’t announced that he’s lessened his opposition to that plan.

“We’ll review any bills the House sends over,” spokeswoman Laura Hipp said. “Over the next few months we’ll be working together to look at ways to fund our infrastructure needs.”

Gunn spokeswoman Meg Annison said Revenue Department figures show $47 million was collected in use tax in the first 10 months of 2017.

However, during that time, online seller Amazon.com bought Whole Foods, acquiring an in-state presence for the first time. That could mean collections from Amazon will no longer be classified as use tax.

In any year when revenue growth to the state General Fund exceeds 2 percent, House Bill 354 would take half that growth above 2 percent, up to $100 million, and use it for road and bridge maintenance. A majority of that money would go to the state, with smaller shares to counties and cities. Growth in the General Fund has exceeded 2 percent only in five of the last 10 years.

House Bill 355 would exempt the Department of Transportation from civil service rules administered by the state Personnel Board, allowing it to reorganize and fire any of about 3,200 employees at will. McGrath said the department doesn’t plan any layoffs, but would like to take money associated with vacant positions and use it to increase employee salaries.

“We don’t need less people, we need better paid people,” McGrath said, saying trained workers are leaving for higher pay. Increasing salaries could require authorization in a separate budget bill.

House Bill 357 would borrow $50 million, giving half to counties and half to cities to repair or replace bridges.

Finally, House Bill 359 would ban the Transportation Department from starting any new road construction for the next two years if it hasn’t already started acquiring right of way.

“I think we’re just trying to show everyone we’re stopping new construction while we fix all the roads,” said Rep. Steve Massengill, a Hickory Flat Republican.

Democrats derided that move and the package as ineffectual attempts to avoid a tax increase.

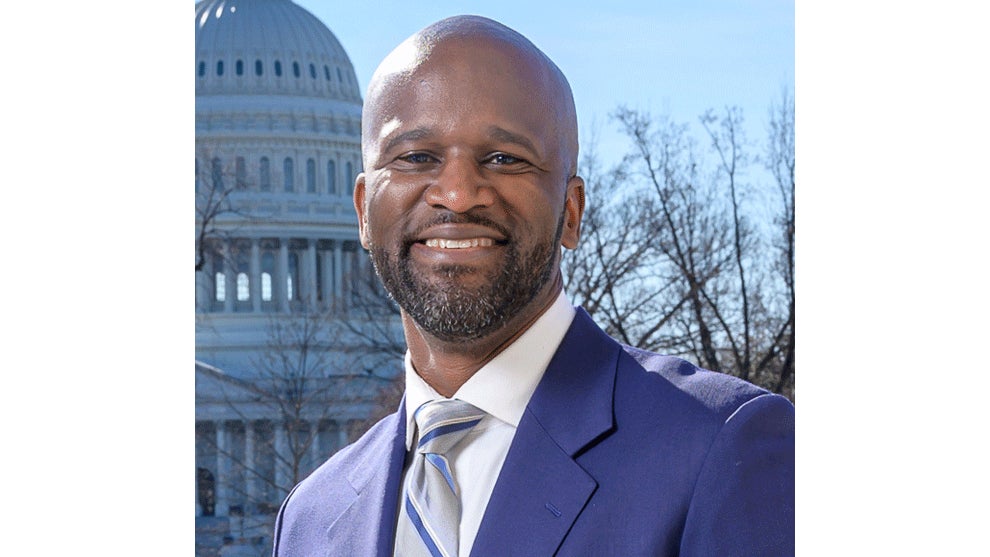

“This is like one snowflake falling on the landscape and calling it a tsunami of snow,” said Rep. Steve Holland, a Plantersville Democrat.

___

Follow Jeff Amy at: http://twitter.com/jeffamy . Read his work at https://www.apnews.com/search/Jeff_Amy .