State revenue rebounds for fiscal year, could bode well for 2019 session

Published 9:23 am Wednesday, July 11, 2018

From Mississippi Today

JACKSON — State revenue collections, which have been sluggish for the past two years resulting in significant budget cuts for multiple state agencies, rebounded during the 2018 fiscal year, which ended on June 30.

According to the revenue report compiled recently by the staff of the Legislative Budget Committee, state revenue collections for the past fiscal year were up $39.1 million or 0.69 percent above the amount collected during the previous fiscal year.

Total collections for the just completed fiscal year were $5.69 billion. In the previous two years, the state experienced essentially no growth or even a negative growth rate for one year.

The stronger revenue collections for the recently completed fiscal year could bode well for the 2019 Legislative session when legislators will be compiling a budget for education, health care, law enforcement and other vital state services during an election year.

It also comes after three sessions where legislators were forced to make significant cuts – 10 percent or more for many state agencies, forcing layoffs and the reduction of services.

The growth in revenue for the just completed fiscal year is more impressive when looking just at revenue collected by the Department of Revenue. DOR collects the bulk of state revenue from general tax levies, such as on retail sales, personal income, corporate income, casinos, tobacco, beer and liquor and some other sources.

Those Department of Revenue collections were up $130 million or 2.6 percent to $5.49 billion.

Other none Department of Revenue sources of revenue, such as settlement funds collected by the office of the Attorney General, were less in fiscal year 2018, accounting for the smaller amount of total state revenue growth – 0.69 percent.

If DOR collections – the major source of state revenue – continue to improve, that especially could bode well for the 2019 session.

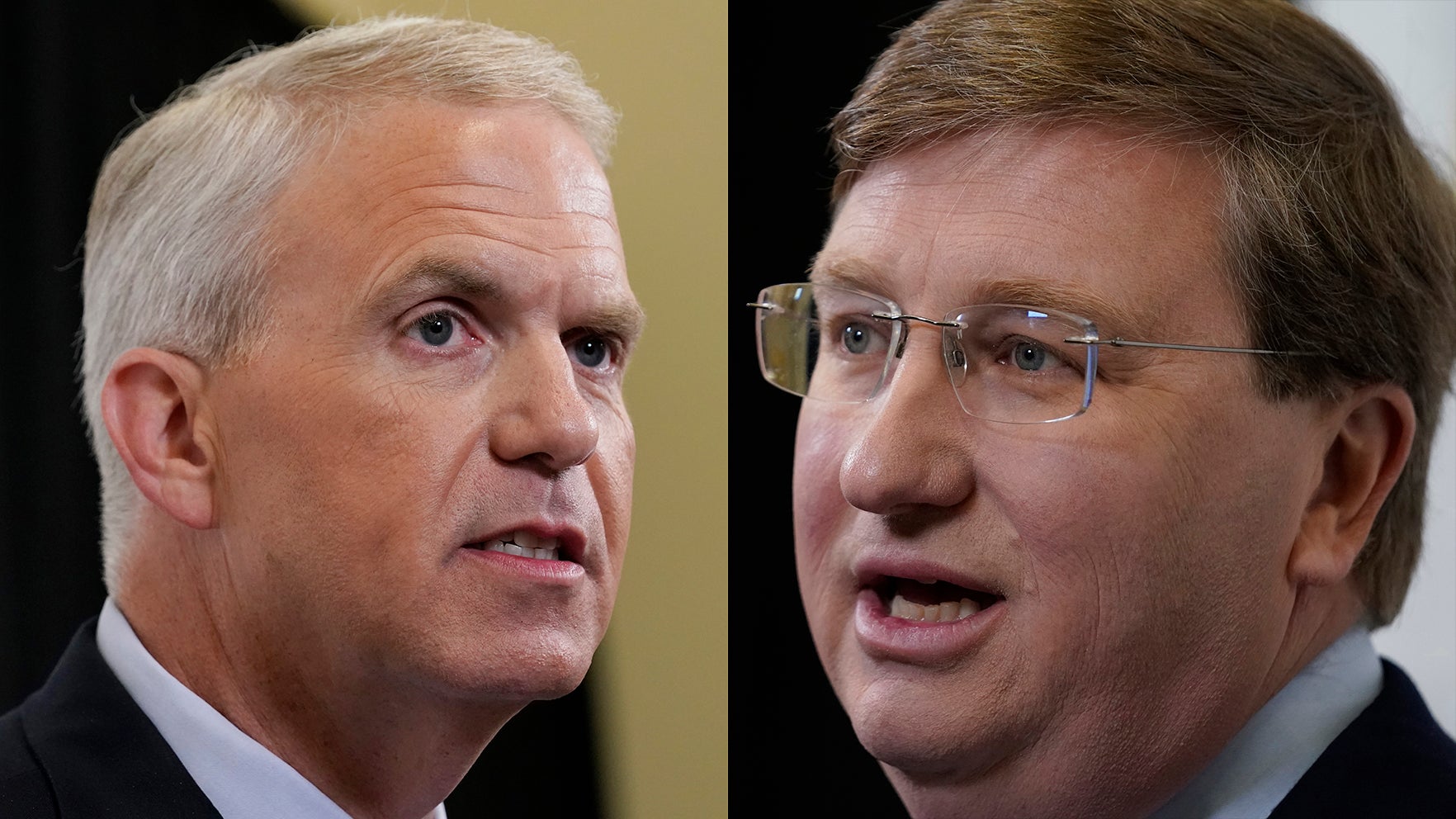

Rep. John Read, R-Gautier, who is in his second year as House Appropriations chair, said he is pleased to see the improvement in collections.

He said, “My first year (as appropriations chair) we were cutting until the last day of the (fiscal) year. That is painful. I don’t care what side of the aisle you are on….

“I am anxious to see what July collections look like. I hope we can get off to a good start for the new fiscal year, give us some breathing room.”

Historically, it is normal for state revenue collections to grow year over year. Growth is normally 5 percent or less unless in unusual circumstances. For instance, the rebuilding after the destruction caused by Hurricane Katrina in 2005 led to two years of growth of more than 10 percent. Multiple years of above average growth rates occurred in the 1990s as the casino industry got off the ground.

During the Great Recession, starting in late 2008, revenues dropped by about 5 percent for two consecutive years before they started to rebound. But that rebound slowed in fiscal years 2016-17. During those years, tax cuts imposed by the Legislature began to kick in.

The Legislature has passed about 50 tax cuts that have taken more than $300 million out of the state’s coffers. The largest of those tax cuts, passed in 2016, is slated to cost the state general fund an additional $415 million over the next 10 years.

Supporters of tax cuts, such as Gov. Phil Bryant and Lt. Gov. Tate Reeves, have maintained that they will result in an improved economy and eventual growth in revenue collections. Others maintain that the state could not afford the tax cuts at a time the state faced so many other pressing needs, ranging from transportation, to health care to education.

“The annual impact to the state of 2016 tax cut bill is going to be $415 million,” said Sen. David Blount, D-Jackson. “The economic growth is so anemic that the state will not be able to catch up to the cost of the tax cut bill.”

Many of the tax cuts were directed at businesses. While the state experienced revenue growth during the just completed fiscal year, corporate tax collections were $572.3 million compared to $714.1 million three years ago before those tax cuts began to kick in. Overall collections, though, are now more than they were three years ago.