Brookhaven tax revenues out-pace past year

Published 11:00 am Wednesday, June 30, 2021

Sales tax receipts for Brookhaven have not lost any steam as they continue to out-pace last year’s numbers.

Sales tax is collected on local sales, submitted on a monthly basis to the Mississippi Department of Revenue, and then paid to cities. Sales tax receipts paid to cities are a direct result of money spent by consumers in those municipalities.

The City of Brookhaven received $621,529.89 in sales tax for May 2021, more than $116,000 higher than receipts for May 2020. For Fiscal Year 2021 — which began July 1, 2020, and ends June 30, 2021 — the first 11 months have seen an influx of $5.95 million in sales tax dollars to the Home Seekers Paradise, an increase of $664,931.95 over the same point in the previous fiscal year.

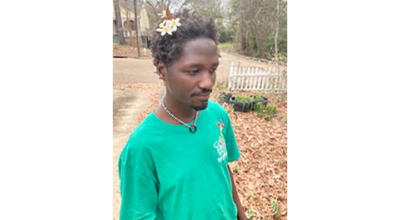

Garrick Combs, executive director of the Economic Development Foundation and the Brookhaven-Lincoln County Chamber of Commerce, believes government stimulus monies and the global pandemic have contributed to an increase in spending.

“I think that in part the pandemic and stimulus monies are driving new spending on things like home repair and renovations, laptops, tablets (and) webcams to work from home,” Combs said. “Also, I think we have been purchasing items like side-by-sides and ATVs as we searched for different ways to have fun while distancing ourselves from others.”

Brookhaven has consistently outperformed many other cities in retail sales, including 16 of the 35 municipalities in the state with larger populations — Greenville, Brandon, Clinton, Pascagoula, Gautier, Ocean Springs, Hernando, Long Beach, Bay St. Louis, Natchez, Clarksdale, McComb, Moss Point, Greenwood, Canton and Grenada.

Jackson has the largest population and had $2.74 million in tax receipts. Twelve other cities had receipts of more than $1 million — Columbus, $1.01 million; Oxford, $1.08 million; Flowood, $1.15 million; Pearl, $1.17 million; Biloxi, $1.21 million; Olive Branch, $1.25 million; Ridgeland, $1.39 million; Meridian, $1.51 million; Southaven, $1.6 million; Tupelo, $2.2 million; Hattiesburg, $2.35 million; and Gulfport, $2.37 million.

Six municipalities had receipts of less than $100 for May — Satartia, $9.90; Falcon, $91.36; Gattman, $81.63; Eden, $64.26; Paden, $59.46; and Paulding, $42.34.

Sales tax data is provided by the Mississippi Department of Revenue. Sales tax has a three-month cycle. In Month 1, tax is collected by the retailer. In Month 2, tax is reported and paid to the Department of Revenue by the retailer. In Month 3, sales tax income (“diversion”) is paid by the DMDOR to cities. This report is based on the month the tax is collected at the MDOR (Month 2).