Analysis: Gambling not a clear-cut state budget booster

Published 5:28 pm Sunday, July 22, 2018

JACKSON, Miss. (AP) — Will Mississippi take a chance on a lottery? It’s a big question lawmakers could answer if Republican Gov. Phil Bryant calls them into special session in the next few weeks.

Officials are looking for ways to generate about $200 million a year to pay for improvements to highways and bridges. Bryant says he will call a session sometime in August if House and Senate leaders can agree on the broad outlines of a funding plan.

Bryant suggests using money from tax collections on internet sales, newly legalized sports betting and creation of a lottery.

A new study from a nonprofit group, The Pew Charitable Trusts, examines “sin taxes” on alcohol, tobacco and gambling, including lotteries and sports betting. It says the taxes are a “tempting but unreliable source of revenue” for states.

“Any of these new, or even existing, sin taxes are unlikely to be a silver bullet for larger budget issues — certainly, when attempting to resolve some of the larger structural budget challenges that many states are facing,” Mary Murphy, Pew’s project director for state and local fiscal health, said Wednesday during a conference call about the study.

Mississippi is one of six states without a lottery, according to the National Conference of State Legislatures. The others are Alabama, Alaska, Hawaii, Nevada, and Utah.

The first legal dockside casinos opened in Mississippi in August 1992, and in November of that year, voters removed the state constitution’s prohibition on a lottery. But legislators have never enacted a state law to create a lottery, partly because of opposition from religious groups, including the large and influential Mississippi Baptist Convention.

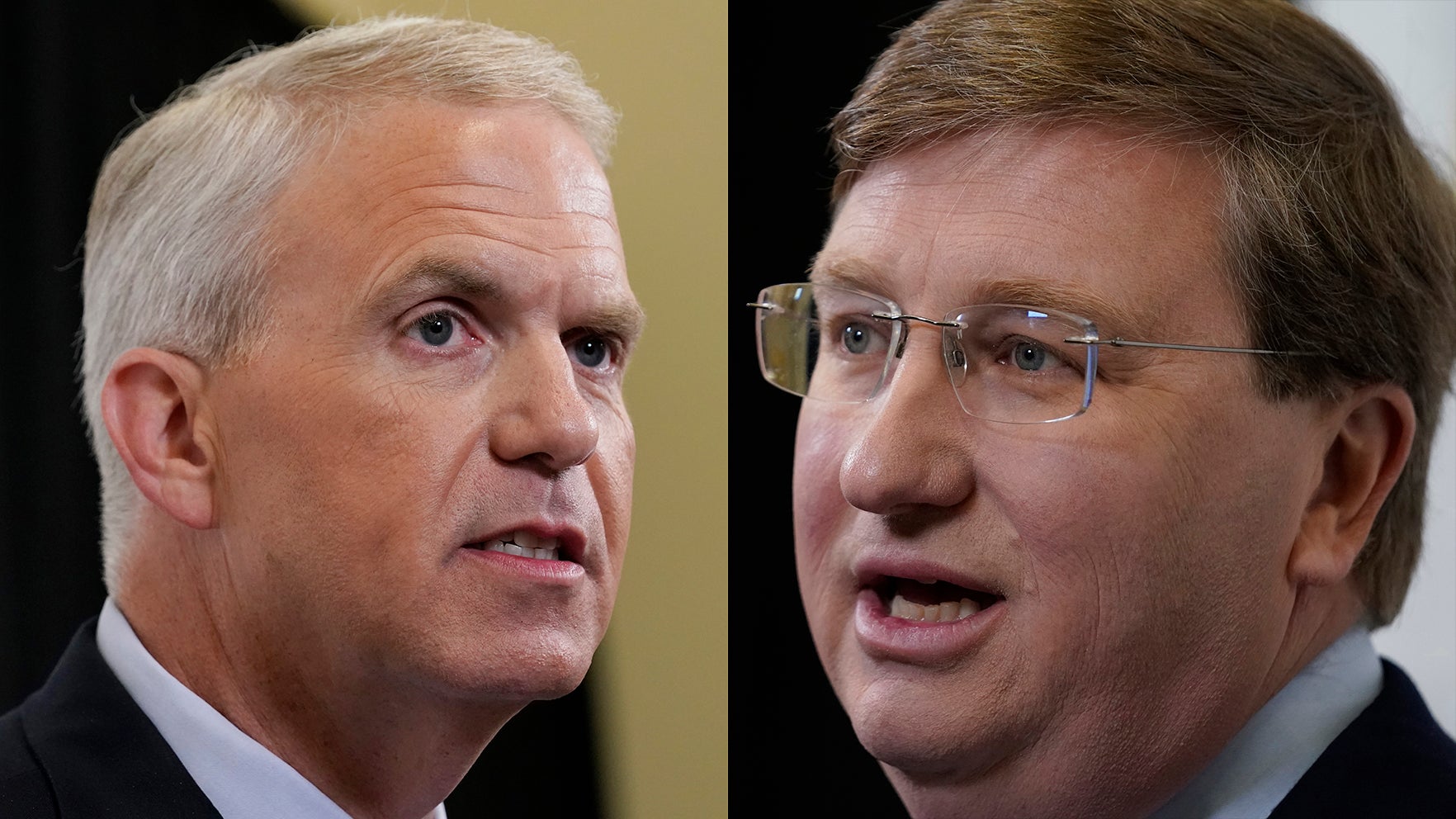

Republican House Speaker Philip Gunn of Clinton, who’s a leader in his Baptist church, opposes the lottery. But Bryant says he believes Gunn will allow the House to vote on the issue if it arises during a special session on transportation funding.

After the 2017 legislative session ended, Gunn created a lottery study group. It examined how much money neighboring states collected, after prizes were awarded and expenses were paid, during the budget year that ended June 30, 2016. The figure for Arkansas was $85.2 million. For Louisiana, it was $177.9 million. For Tennessee, it was $395 million.

Mississippi residents spend an estimated $5 million to $10 million a year playing the lottery in Arkansas and about $30 million playing the lottery in Louisiana, Mississippi’s state economist, Darrin Webb, said in November.

The study group made no recommendations for or against creating a Mississippi lottery, and legislators had little discussion about it during the 2018 regular session that ended in late March.

In May, the U.S. Supreme Court struck down federal law that prohibited gambling on football, basketball, baseball, and other sports in most states. Mississippi had already changed its law in 2017 to allow sports betting, as part of a bill to legalize and regulate fantasy sports.

After the Supreme Court ruling, the Mississippi Gaming Commission set rules specifying that in this state, betting on any pro, college or Olympic sport will be confined to casinos.

Sports betting is expected to begin soon in Mississippi, and it is projected to produce less than $10 million a year in state revenue. Casinos will pay state and local taxes worth 12 percent of the wagers, minus the payouts.

The Pew report points out that “gambling taxes also come with caveats.” States with lotteries have seen little revenue growth from them in recent years, and casinos have struggled with competition as opportunities for legal gambling have proliferated.