Mississippi bucks national trends in home and car sales

Published 10:04 am Monday, April 27, 2020

(AP) — Homes and cars. They’re selling big right now in Mississippi — something one might not expect in times of social distancing and widespread unemployment.

But the COVID-19 pandemic has had a surprising effect: lowering interest rates. It has set up deals on cars for the right kind of buyer. It has created low inventory in the housing market. And it has eliminated the “just looking” crowd.

“I think the market is still pretty hot,” Katie Warren, owner of Turn Key Properties and Central Mississippi Realtor president said. “You don’t see a lot of looky-loos. If they are out looking, they’re writing contracts.”

HOW LOW WILL INTEREST RATES GO?

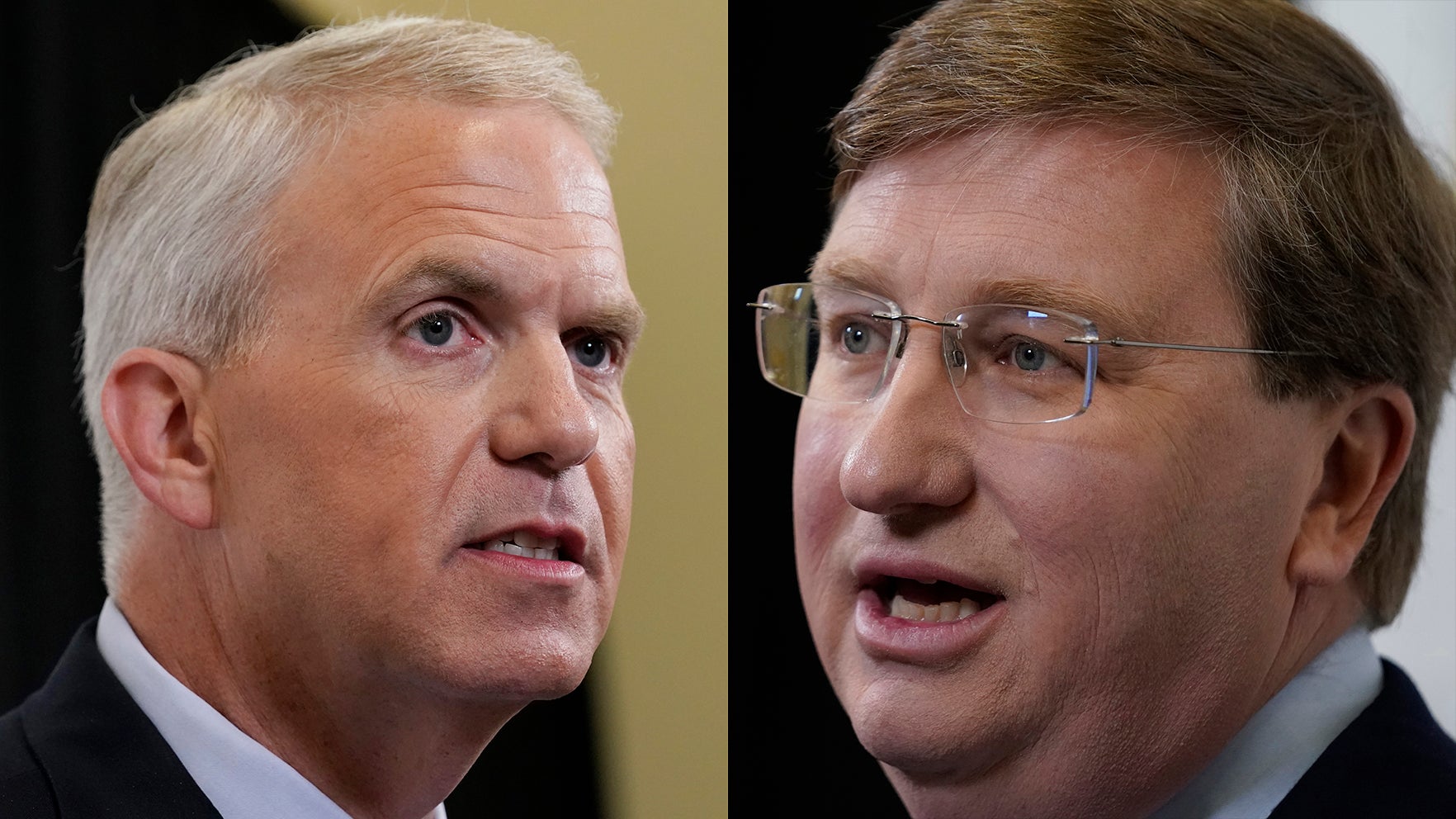

Mortgage brokers, real estate agencies and car dealers are considered essential services, according to Gov. Tate Reeves’ executive orders.

While all are doing good business in Mississippi, national trends may differ. Surveys show car and home sales have decreased in other parts of the country.

Many folks have kept their homes off the market because of concerns about coronavirus, but the pandemic has led to low interest rates.

“The coronavirus caused a lot of fear in the lending industry,” said Blair Chandler, senior loan officer with Fairway Independent Mortgage Company in Ridgeland. “The federal government came in and purchased a lot of mortgage-backed securities.”

According to HousingWire.com, the buying of mortgage-backed securities is aimed at providing liquidity and pushing interest rates lower, which would bolster the economy.

Warren said buyers don’t have a lot to choose from, but they are finding great deals on interest rates.

“Rates are very phenomenal right now,” Chandler said.”Right now, historically speaking, we are at some of the lower levels since the 2008 housing crisis.”

Chandler said a lot of factors go into the interest rate a home buyer can get on a mortgage. In general, though, 30-year mortgages are going for 3% to mid-3%, while 15-year mortgages are at upper 2% to lower 3%.

A year ago, a 30-year mortgage had an interest rate of more than 4%, while a 15-year mortgage interest rate was also above 4%.

“We’re allowing people to get into their dream home with a very low payment,” Chandler said.

Rates could even go below 3%. That would help realtors make even more sales, while they keep abreast of coronavirus protections.

“Agents are wiping down doorknobs and counter tops to be safe for clients and homeowners,” Keith Henley, president of the Mississippi Association of Realtors in Jackson, said. “We’re screening buyers to see if they are a carrier (of the coronavirus).

“Do they have flu-like symptoms? Have they been out of the country?”

CARS ARE ‘SO CHEAP’

Cars are a hot commodity too. And that goes for the employed and unemployed.

Many manufacturers are offering incentive pricing or — to those who have lost jobs — deferred payment plans.

For example, Hyundai is offering 0% APR financing and 4 months of deferred payments on select new vehicles through April 30. Chevrolet is offering interest-free APR financing for 84 months for very well qualified buyers on some models. Toyota is offering various local specials.

Some car dealers are willing to do a vehicle purchase, including delivery and paperwork, without the buyer setting foot in the dealership because of concerns about the coronavirus.

Lynn Howell, co-owner of Insurance Protection Specialists in Flowood, said she’s been writing policies on a lot of used cars because dealerships are dropping prices.

“People are buying cars that are so cheap,” Howell said.

Tony Lawler, executive director of Mississippi Independent Auto Dealers Association in Pearl, said his used car dealers are taking protections to prevent the spread of the coronavirus.

Sales forces with more than 10 people work staggered shifts. Employees practice social distancing. Surfaces in used cars are wiped down.

“I’m fielding daily calls from members of our association,” he said. “A lot of them are selling vehicles, while in some states they’re not.

“Everybody uses common sense and abides by the guidelines the best we can. A lot of (customers) are buying over the internet and sales people will take care of them and set up an appointment. People are still buying.”

WHERE IS MISSISSIPPI HEADED?

The website Cash Cars Buyer reports the automaker and car market have not yet felt the full impact of the coronavirus. Experts expect a future decline in sales and a production slowdown, especially after the closure of many plants.

On March 18, Nissan in Canton said it would halt production at the plant. It paid its workers for two weeks starting March 20. On April 6, Nissan temporarily laid off 4,000 hourly workers.

Plant closures can slow down the production of 2021 models. There also could be a shortage in parts from countries affected by the coronavirus.

Auto sales are expected to decline by at least 15.3% in 2020 as the coronavirus wreaks havoc on the economy, according to a forecast by research firm IHS Markit.

As for home-buying, a survey by the National Association of Realtors said nearly six out of 10 members buyers are delaying home purchases for a couple of months, while a similar share of members said sellers are delaying home sales for a couple of months.

“Much of the activity looks to reappear later in the year,” said the group’s chief economist Lawrence Yun in a statement.

But Yun may be overly optimistic. The real estate market may be affected, according to SmartAsset.com, as people face greater unemployment and investment losses leading to less liquidity to buy homes.

Unemployment is a factor for Chandler as he finances mortgages. Before coronavirus, he checked a borrower’s employment status a week to a few days before the loan. But not now.

“We are in a different time in the mortgage industry, where we have to do due diligence,” he said. “We can’t close a loan for someone who might be facing a job loss (We have to check) the day of closing.”

Those precautions haven’t stopped Warren from selling houses.

“COVID-19 has made less houses to choose from because fewer people are putting their houses on the market,” she said. “We’re in a full-blown sellers’ market.”