The Mississippi Republican income tax bet

Published 11:00 am Tuesday, February 22, 2022

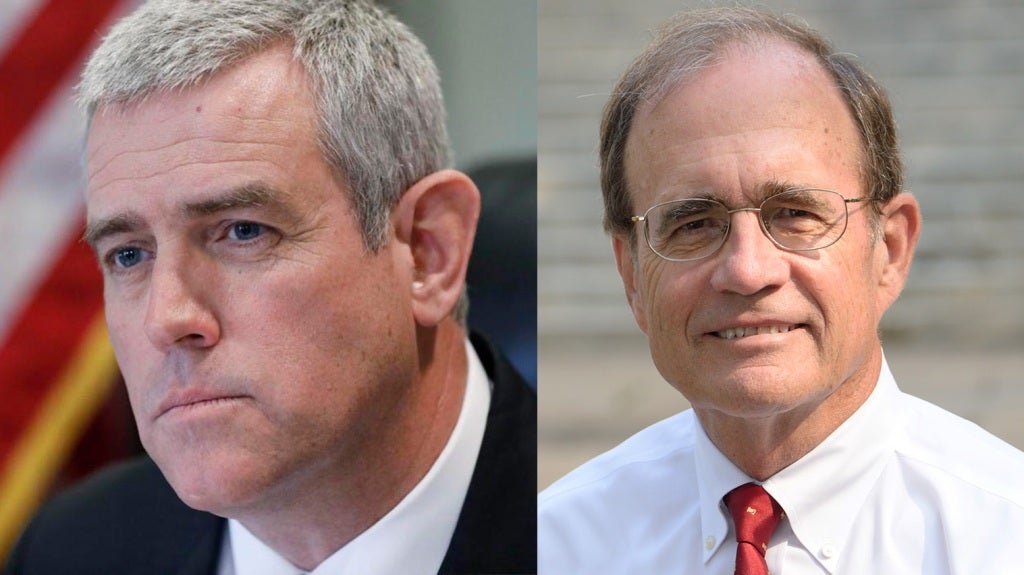

- File photos State Speaker of the House Philip Gunn and Lt. Gov. Delbert Hosemann.

Mississippi faces a critical teacher shortage due in part to lawmakers paying them less than any other state. Meanwhile, many of the teachers we do have don’t have the classroom resources — and sometimes even actual classrooms — they need to adequately teach their students.

Agencies that provide critical government services are hemorrhaging staff because state employee salaries have been so low for so long that staffers are entering the more lucrative private sector.

Businesses across the state struggle to attract and retain workers because the prospective workers often lack the specific education or skills necessary to do those jobs effectively.

Aging roads, closed bridges and broken water systems are disrupting the everyday lives of so many Mississippians. Police and ambulance services are reporting staff shortages that could jeopardize the ability to provide timely emergency attention. Hospital leaders are begging lawmakers to help keep them afloat as they continue struggling to weather the pandemic.

Mississippi’s house is not in order. Mississippians across the state are struggling. They’ve been struggling. But these realities appear to have escaped Republican leaders inside the Capitol.

Speaker of the House Philip Gunn is exerting every ounce of political capital he has to eliminate the Mississippi personal income tax, which accounts for about one-third of the state’s general fund revenue to fund basic government services like the ones listed above. In response, Lt. Gov. Delbert Hosemann offered a shallower income tax cut, but one that many believe also threatens the state’s ability to fund basic public services.

“We have done everything,” Gunn said recently. “We have funded all of the government. We have excess money. Let’s give it back.”

Mississippi currently has more money than it ever has. Revenue is currently soaring, thanks in large part to federal stimulus dollars that have poured into the state — both to individuals and to the state government. Many are calling this moment a once-in-a-lifetime opportunity to address some systemic problems the state has long faced. Others are just calling it once in a lifetime.

Republican leaders aren’t walking onto the floor of the Beau Rivage, but they sure look poised to place the biggest bet of their lives. To sell their income tax cut proposals, they’re pointing to projections that are based solely on the best guesses of economists. Keep in mind, these projections are often very wrong because they are guesses. (This current fiscal year, revenue collections will likely be about $1 billion off last year’s “best guess.”)

The bet Republicans are making, in essence, is that Mississippians will spend the income tax money they’re “saving” them in other ways, and that other tax collections will rise. No state has ever fully phased out a personal income tax, so there’s true way to know if this bet will pay off.

If they’re right, the Mississippi state government will continue to be funded. If they’re wrong, government budgets will have to be slashed to balance the state budget and Mississippians will miss out on even more basic government services that they’re already not getting enough of.

Ask teachers, who have long been underappreciated and underpaid by lawmakers. Gunn and Hosemann are pushing their own versions of a pretty substantial pay raise for teachers that will cost the state about $200 million more per year. Education groups aren’t so sure the pay raises — not withstanding basic public education services — will be funded in perpetuity if this tax cut bet doesn’t pay off.

“If Mississippi has plenty of money, the Legislature has no excuse for not fully funding public schools and bringing teacher pay to the Southeastern average — before giving away any state funds,” wrote Nancy Loome of public education advocacy group The Parents’ Campaign. “If Mississippi does not have sufficient state funds to properly provide for our children and teachers, we certainly can’t afford a tax cut.”

Ask retirees, a majority of whom don’t currently pay income tax, what they think about having to pay a higher sales tax on many of the things they spend their money on. Ask advocates for lower-income Mississippians, who could likely pay more in taxes if the Gunn plan is adopted.

“The (tax cut proposal) is like putting lipstick on a pig. No matter how you dress it up or down, eliminating the income tax is bad for Mississippi, especially the state’s working families, communities of color, and retirees,” advocacy group One Voice wrote in January. “The state’s surplus is not enough to support much-needed investments in the public services that Mississippians want, like quality schools, affordable healthcare, solid infrastructure, safe neighborhoods, and affordable housing nor is it enough to support yet another tax cut that largely benefits the state’s wealthiest.”

Ask the leaders of Mississippi’s largest businesses, who continue to publicly maintain that cutting the income tax will not help them attract and retain a better workforce.

“The Mississippi tax environment was not high profile nor even discussed significantly as a priority,” said a report released by the Mississippi Economic Council last week. To compile that report, MEC held 51 town-hall style forums with business and community leaders across the state and from numerous sectors from July through September of 2021. The income tax issue didn’t even come up at any meeting until the end of August.

“There was the thought (eliminating the income tax) could drive other costs up and it could hurt the state budget and households,” the business council’s report said.

The Tax Foundation, a conservative think-tank, said that Mississippians paid $614 per capita for income taxes in 2020. That’s a nice chunk of change that no one would turn down. But considering so many government services aren’t already provided, what would that extra spending money really look like for Mississippians? Is it real relief?

For teachers, it could be some extra money to buy their students classroom supplies and teaching resources that aren’t covered by the state. For drivers, it could be a new set of tires that need replacing because the roads are in such bad shape. It could provide some relief for Mississippians who pay higher water bills as systems continue requiring costly repairs, or higher medical bills because understaffed hospitals will have to drive up costs.

For Mississippians looking for better jobs, it could be tuition money for the skills training that they can’t currently get in their county, or gas money to drive long distances to places where the jobs actually exist.

The income tax money that taxpayers would be “saved” would, in many cases, have to be spent plugging holes that lawmakers have left themselves — Mississippians forced to spend money they wouldn’t otherwise have to because lawmakers didn’t do their jobs well in the first place.

While Republican leaders continue to use best guesses to allay all these concerns, Mississippians may soon be forced to watch their big bet play out over the course of the next few years. And the stakes sure will be high.