It’s a privilege doing business; Businesses must have a license

Published 12:00 pm Wednesday, May 25, 2022

Having a business is a privilege, and a privilege license is needed.

“It’s simple. Anyone with a named business needs a privilege license,” said City of Brookhaven Privilege License Clerk April Williford.

Mandated by the Mississippi State Tax Commission, the mandatory tax is for the privilege of doing business within a municipality. This applies to all for-profit businesses, with some exemptions.

There are nine types of licenses in Brookhaven — manufacturing, automobiles for hire or rent, coin-operated laundries, pawn brokers, retail stores, deadly weapons dealers, drilling rigs, optometrists certified to use diagnostic pharmaceutical agents, dealers purchasing precious items for resale, and general business for anything not covered by one of the other categories.

A business may qualify under more than one category — such as a pawn shop that resells pistols — and require a license in both areas. Licenses can range from $20 to several hundred dollars, depending on the type and size of the business.

An established or new Mississippi business owner is likely aware of what is required from the state — such as a tax ID number and registration with the Secretary of State’s Office — but may not realize a local license is also needed in order to operate. Businesses inside the city limits of Brookhaven must obtain a license from the City Clerk’s office. Businesses outside the city limits must obtain a license from the county Tax Collector’s office.

In order to open a new business in the city, the first step is to get a building inspection and make sure the proposed physical location of the business is zoned correctly. A sign permit must also be obtained. All these should be done through the office of City Building Inspector David Fearn, Room 103 in the Lincoln County-Brookhaven Government Complex. Fearn can be contacted at 601-833-7766.

Next, a fire inspection must be successfully completed. City Fire Inspector Stanley Dixon must be consulted prior to any wiring or construction for advisement on any possible safety issues. Dixon can be contacted at 601-833-7417 or 601-757-1048.

If the business is a restaurant or will serve food in any capacity, it must then obtain an inspection from the Health Department. Food Protection can be contacted at 601-576-7689.

Once the inspections, zoning and sign permit are obtained, the business owner must then register their new business — newly-created or new to the state — with the Secretary of State’s Office by visiting www.ms.gov/sos/onestopshop/Steps. Then a state tax ID number must be obtained, by calling the Department of Revenue at 601-923-7700 or registering online at www.TAP.com.

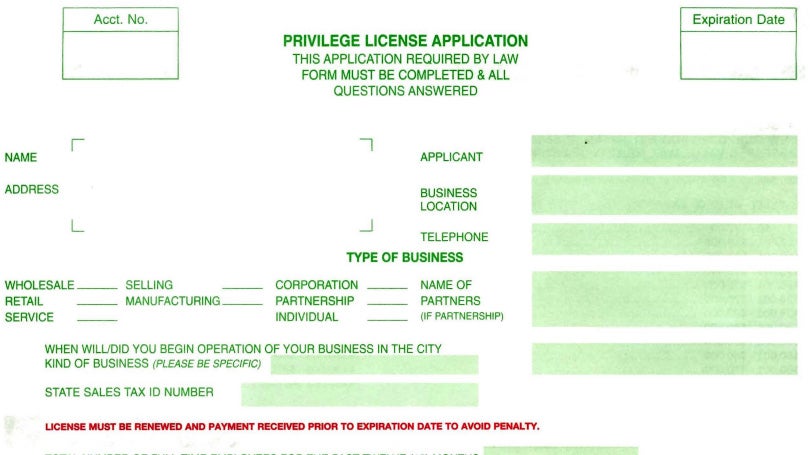

Finally, the business owner needs to get a privilege tax license from the City of Brookhaven. Applications are available online at www.BrookhavenMS.com or in person at the City Clerk’s Office. Williford can be contacted at 601-833-2362 or awilliford@brookhaven-ms.gov.

A business that will be in operation for less than six months requires a different type of license — a transient vendor license — also available through the City Clerk’s office.

Some businesses are exempt from the licensing requirements, however. Some exceptions are civic and non-profit organizations; wholesale trade shows or conventions; sales by catalog for future delivery; fairs and convention center activities conducted primarily for amusement; general sales sponsored by churches or religious organizations; residential garage sales; handmade items; and agricultural products grown in Mississippi.

Anyone qualifying for an exemption must still file an exemption form with the City. For a complete list, visit the City Clerk’s office.

A person selling homemade candles and wooden signs from a booth at the Ole Brook Festival would not need a privilege license. A brick-and-mortar business that sells “handmade” items in its storefront must have a privilege license, however. A person selling the homemade candles and signs from the back of a pickup truck in a parking lot must have a transient vendor license — and permission from the owner of the property.

A grocery store that has Mississippi-grown watermelons as part of its inventory must have a privilege license. A farmer selling Mississippi-grown melons from a trailer does not need a privilege or transient vendor license — but still needs permission from the owner of the property where they are temporarily parked.

A teenager who cuts his neighbor’s grass for cash is not required to have a license. But if he forms a named business with a sign of any kind — such as in a yard or on his trailer — he must have a privilege license and be registered as a business within the state.

Privilege licenses are issued for one year at a time, renewable 12 months from the date first purchased, and are non-transferable. Penalties are added to licenses that are not kept up-to-date.

“We want everybody to stay legal,” Williford said. “And remember this is mandated by the Mississippi State Tax Commission.”